Say Goodbye to the Home Office Deduction Unless You Do This The Motley Fool

Table of Content

There are qualifications and limits for this deduction, so getting help from a licensed tax professional is an important first step to adding this deduction to your business tax return. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing. If you meet patients, clients, or customers in your home office in the normal course of business, your home office might qualify for a deduction.

If you switch employers, you'll have to start from scratch. You may not create or increase a loss from employment by carrying forward home office expenses. This is an optional tax refund-related loan from Pathward, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

Time Flies By Faster As We Get Older. Here's Why.

One move that stayed under the radar was the elimination of the deduction for those employees who maintain a home office. The loss of the home office deduction for employees has some taxpayers wondering whether it makes sense to quit their jobs and become self-employed. That's an individual decision, but if you're focusing simply on the home office piece, the numbers probably don't support that kind of shift. For more to consider when it comes to business-related decisions in light of tax reform, check out this article. In past years, all of the expenses that went into sprucing up my space - from paint to new furniture - would have been deductible as home office expenses on Schedule A of my income tax return.

For an employer’s reimbursement of home office expenses, the IRS allows employers to set up a Section 125 Cafeteria Plan. This allows employees to pay for expenses covered under the plan with pre-taxed dollars. If John, in the example above, and his employer agree to set up a Cafeteria Plan to cover his home office expenses, it would look like this.

Taxes done right for freelancers and gig workers

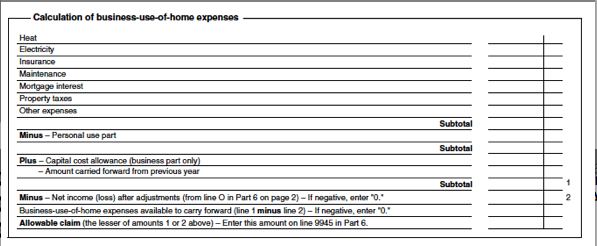

If you sometimes use the space for leisure, figure out what percentage of a 24-hour day you use it for work. Then use these figures to determine the deductible portion of your expenses, as indicated in the Revenu Quebec example above. If you are a renter, you can deduct the portion of your rent and expenses that relate to your home workspace.

Additional training or testing may be required in CA, OR, and other states. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials.

Support

The owner must use the space regularly and exclusively for business purposes and it must usually be their principal place of business. Description of benefits and details at hrblock.com/guarantees. If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. Searches 500 tax deductions to get you every dollar you deserve.

A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules. The key thing to remember, though, is that tax reform didn't take away home office expense deductions for everyone. If you're self-employed, nothing has changed, and you still can claim the deduction on your Schedule C as you used to. Many employees take work home with them, but it's not enough just to have a dedicated space for doing that work.

More In Money

If you use the home office space for only part of the year, be sure to use only expenses for the period of time when the space was in use. John and his employer agreed to a Cafeteria Plan to cover his home office expenses. John contributes $1,500 to the plan to cover his home office expenses. Some of the information on this website applies to a specific financial year. Make sure you have the information for the right year before making decisions based on that information. His employer provides him with the equipment necessary to fulfil his work functions and they pay for a work, health and safety check on the room he uses for working at home.

If you are self-employed and work at home — even just part-time — you may claim a home office tax deduction for expenses related to your home office. Alas, if you’re an employee who has been working from home due to the COVID-19 pandemic, that amazing home office tax deduction you’ve heard so much about does not apply. Enrollment in, or completion of, the H&R Block Income Tax Course or Tax Knowledge Assessment is neither an offer nor a guarantee of employment. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable. The Income Tax Course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Additional time commitments outside of class, including homework, will vary by student.

Owners of home-based businesses may be eligible to set up retirement plans for self-employed people. SEP IRA and solo 401 plans can provide current-year tax deductions while also allowing investment gains to multiply without incurring additional tax until withdrawals begin. In other words, to be deductible, your home office must be your actual office and not just at your home for convenience. And more importantly, if you use part of your home as a workspace, it must be space that is used solely for business.

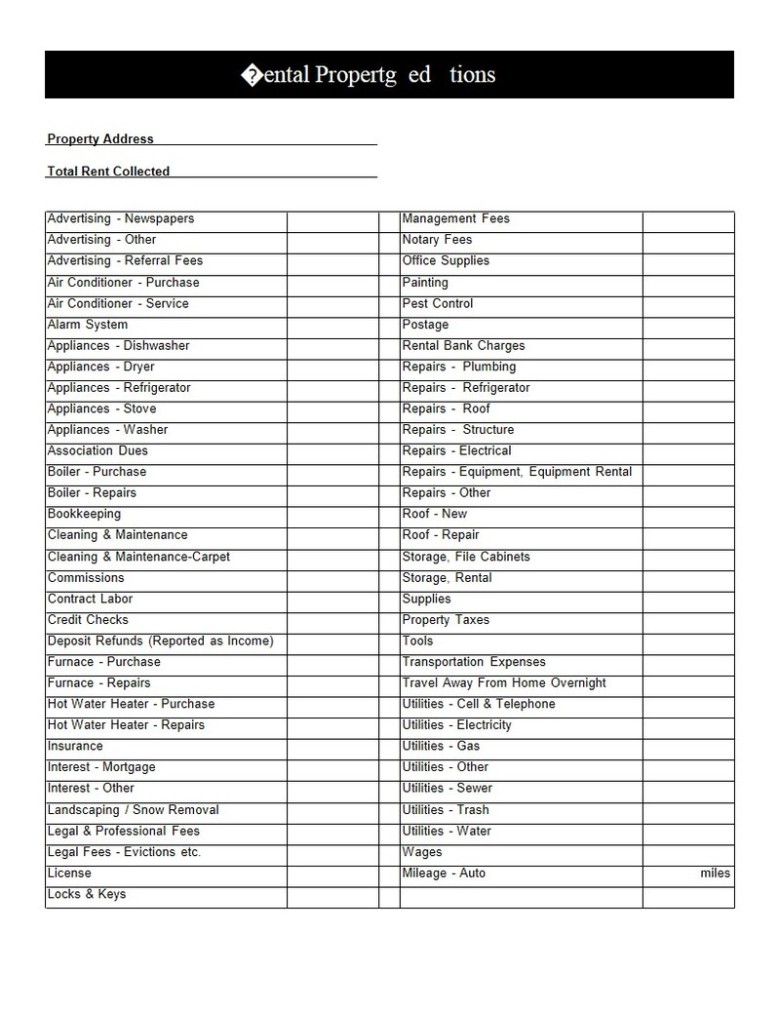

You can claim a deduction for the additional running expenses you incur as a result of working from home. This home office needs to be only used for your business — as in, it can't be a guest room with a desk in it — and you must be able to prove that you need an office for your work. The burden of proof for taking this deduction is on the taxpayer, so if you're audited, you will have to back up your claim to the IRS. Home office business expenses are divided into direct and indirect expenses. Direct expenses are those for just your home office business space, like painting or repairing the space. To use the actual-expenses method, you’ll need the gross income from your business for the year .

Commission employees can add a few more expenses to their claims, and sole proprietors and partners can add even more. If you do meet one of the above conditions, you can deduct the portion of your expenses that are related to your home office from your income. If you are a business owner, partner in a partnership, or self-employed, you may be able to deduct expenses such as mortgage interest and capital cost for equipment such as furniture. Yet the deduction was also available to those who worked for an outside employer in certain cases.

The tax break is generally only for those who are self-employed, gig workers or independent contractors, not those who are employed by a company that gives them a W-2 come tax season. The good news is this change only applies to new homeowners, according to Josh Zimmelman, owner of Westwood Tax & Consulting. Documents proving that the area is used repeatedly and solely for business purposes. The limitation on the maximum amount of the home office deduction.

This new method uses a prescribed rate multiplied by the allowable square footage used in the home. If you're an employee working remotely rather than a business owner, you unfortunately don't qualify for the home office tax deduction . Prior to the Tax Cuts and Job Act passed in 2017, employees could deduct unreimbursed employee business expenses including the home office deduction.

Comments

Post a Comment